By Jyoti Kumari

The acronym “robo-advisor” encapsulates the digital disruptions in digital wealth management for efficient investment decisions, portfolio creation, and diversification in the capital markets.

Robo advisors are the product innovation. In the disruptive fin-tech language, the purpose is to enhance the functioning of capital markets and demystify the conventional wealth management approach. Robo-advisors gained momentum in capital markets with technological innovations such as artificial intelligence (AI), big data, and data science. With the advent of these digital solutions, capital markets can accelerate low-cost investment decisions and assets under management (AUM).

Investment bank Morgan Stanley predicted in November 2015 that several European financial institutions would pilot robo-advisor (or simply robo), many of which collaborate with start-ups as the most cost-effective way to promote digital wealth management.

The New York Times defines robo-advisors as a definite class of financial advisors that provide online services with “minimal personnel intervention”. Henceforth, robo-advisors, so-called technological innovations, can revolutionize the traditional organizational capital market paradigm and digital wealth management.

Virtual robotics' application to the financial robotics industry is incredible, with particular reference to capital markets. This article will explore how the Indian capital market is growing with millennial customer participation and accelerating with virtual robo-advisors.

Robo-advisors in the fin-tech industry is the productinnovation to leverage the traditional method of investments and returns analysis. The robo-advisor business model is based on three fundamental pillars: robotic automation process (RPA), analytics, and advisor-assisted. Among all Fin-tech start-up wealth management companies, the wealth front comes first, and that is the American digital wealth management company.

Wealthfront is the first fin-tech capital market company to be initiated and offers investment services by fully employing complex algorithms. The company bases its investment strategy on identifying the risk tolerance of an individual or an institution, the investment goals, and the investor's budget through a streamlined questionnaire. Afterward, it automates the process through complex software designed to automatically adjust customer-preferred portfolios, keeping them diversified and tax efficient while maintaining the target allocation.

The second top digital wealth management company, Betterment, a New York-based American company, is a fully automated, robo-advisor company, providing automated investment advice at meager fees (aligned with fully computerized companies, from 0.15% to 0.35%. Of late, several fin-tech companies such as Personal Capital, MoneyFarm, and Vanguard Digital Advisor have come into existence with multiple opportunities in the digital wealth management landscape for risk identification to risk diversification worldwide.

Indian capital markets as an emerging market and investment heaven is not untouched by the sway of worldwide technological innovations and digital wealth management to facilitate the market's incumbent players. The Robo-Advisors market in India is projected to witness significant exponential growth in the coming years.

According to the market forecast, the assets under management in this market are expected to reach a staggering amount of US$19.76 bn in 2024. This growth is likely to boost further, with an estimated annual growth rate (CAGR 2024-2027) of 9.21%, resulting in a projected total of US$25.74 bn by 2027.

Moreover, the number of users in the Robo-Advisors market is expected to rise to approximately 3.250m by 2027. This indicates a growing interest and adoption of the Robo-Advisors market among investors in India. In terms of average assets under management per user, each user is anticipated to have around INR US$6.45k invested in the Robo-Advisors market by 2024. This showcases the potential for significant wealth accumulation through these platforms.

Indian capital markets are witnessing a fathomable shift, as with the announcement of SEBI in terms of retail registered investor participation in India. NSE India press release on 01.03.2024 highlights the NSE registered investor base crosses 9 crores (90 million) unique investors (unique PANs) and 16.9 crores (169 million) in terms of total accounts as of1st March 2024.

The investor base has jumped three times in the last five years. The unique investor registration acceleration is due to digital innovations such as implementing artificial intelligence, data science, and robo-advisors to create fin-tech stock broking companies and wealth management.

Digital innovations promote financial inclusion and investor awareness among retail investors. The steep jump in the number of registered individual investors is because digital wealth managers and wealth tech business models which are exclusively participating in contemporary times to attain financial inclusion in the Indian economy.

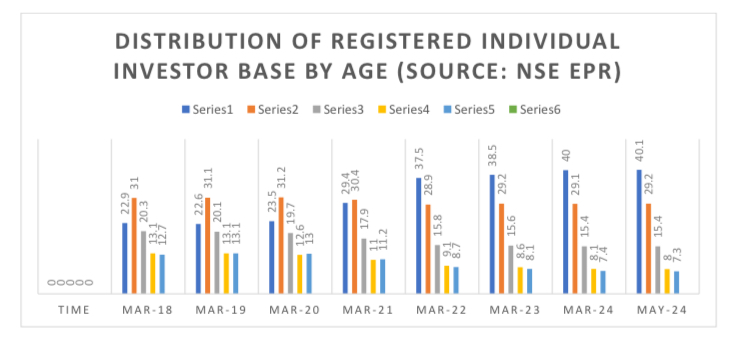

The segment of the population that invests in robo-wealth advisors is the millennials (60% of the population under age 40) and baby boomers, representing the population emerging as the wealthiest in the upcoming decades. The snapshot below presents the growth trajectory of the participation of millennials in the financial markets, with reference to the stock broking companies in the Indian stock market.

Note: Only individuals and sole proprietorship firms have been considered in the above table. Fiscal year 2025 is mentioned as 31st May

2024.

The presented data of NSE EPR series 1 represents the Indian retail investor age group less than 30 years. Series-2 represents the age group between 30-39 years, and series-3, 4,5, and 6 are the age groups 40-49, 50-59, and 60 and above.The graph reveals that the participation of young millennials has accelerated over the years due to risk appetite and adaptation toward risk identification, risk tolerance, portfolio creation, and rebalancing with the assistance of the robotic automation process (RPA).

The registered individual Indian investors falling in the age group below 30 years are the risk seekers in the market, and they grew from 22.9% in March 2018 to 40% in March 2024 and are anticipated to grow to 40.1% during March 2025. The young Indian population (the millennials) is more tech-savvy. It promotes digital robo-advisors-based investment decisions, which provide customized lowest-cost products to attain the highest Assets Under Management (AUM).

Moreover, further credit can be dedicated to the robo-advisor-based customized stock broking companies, namely Zerodha, Upstox, Angel One, Groww, ICICI Direct, 5paisa, etc. These share brokers are now authorized members of the Indian stock exchanges (i.e., NSE and BSE).

The penetration of easy access to the internet, mobile banking, and digital wealth tech firms encourages young millennials to participate in the stock markets. In the future, India will witness exponential growth in the millennial's participation in the stock market.

Overall, the Robo-Advisors market in India is poised for substantial growth, with increasing assets under management, a growing user base, and the potential for significant returns on investment.

In a nutshell, the future of virtual robotics and robo-advisorsin the Indian financial market will be to reshape the financial industry and further bring financial inclusion.

Virtual robotics is the relentless effort of automation adaptation in the BJP-led ruling party to digitalize India and further promote financial inclusion in India. The data of NSE suggests that the percentage of the population, essentially the millennial class of investors, will show a steep spike in the upcoming years due to reduced delivery costs of all financial products.

Nevertheless, the constraints lie with the top high net-worth individuals and institutional investors still believing in the conventional framework of investments in face-to-face relationships.

Advanced fin-tech wealth management companies will counter these challenges in the coming years. Still, continuous fin-tech digital wealth management initiatives will compete with traditional companies that usemore and more advanced robots.

The writer is an assistant professor at IFMR GSB Krea University in Quantitative Finance and Accounting Department

The BuckStopper, run by a group of seasoned journalists, holds the powerful accountable. The buck stops with them, as they cannot shrug off their official responsibilities.