The Union Cabinet, chaired by Prime Minister Narendra Modi, on Saturday approved the Unified Pension Scheme (UPS), which aims to provide assured pension, family pension and assured minimum pension to government employees.

Under UPS, the government has assured 50 per cent of salary as pension for government employees.

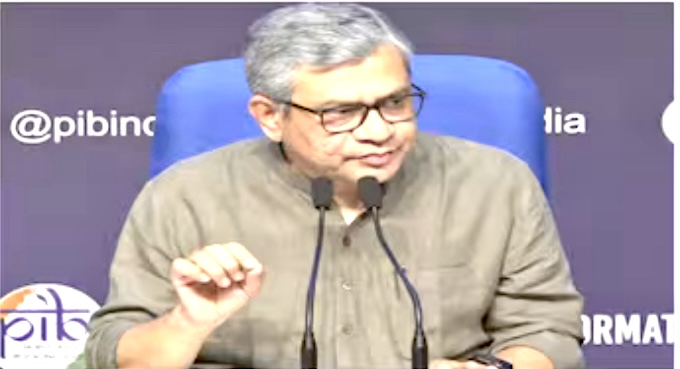

“Today the Union Cabinet has approved Unified Pension Scheme (UPS) for government employees providing for the assured pension…50% assured pension is the first pillar of the scheme…second pillar will be assured family pension…About 23 lakh employees of the central government would benefit from the Unified Pension Scheme (UPS)…There will be an option for the employees to opt between NPS and UPS…,” announced Union Minister Ashwini Vaishnaw ahead of assembly elections in one state and a Union Territory this year.

What's there in Unified Pension Scheme

The UPS, approved by the Cabinet gives assured pension, family pension and assured minimum pension to government employees:

Assured pension scheme assures 50 per cent of the average basic salary for the last 12 months before retirement as pension for government employees who complete a minimum of 25 years in service.

The family pension aims to help the pensioner's family to get 60 per cent of the pension received at their time of death.

The minimum pension scheme assures Rs 10,000 per month after retirement for for government employees after minimum 10 years of service.

According to the current pension scheme, the employees contribute 10 per cent while the central government contributes 14 per cent, which would be increased to 18 per cent with the UPS.

Difference between OPS and UPS

TV Somanathan said that the UPS is still more fiscally prudent. “One, it remains in the same architecture of a contributory funded scheme. That is the critical difference. The OPS is an unfunded non-contributory scheme. This (the UPS) is a funded contributory scheme,” he said. In fact, employee contributions are set to be hiked to 18.5 per cent.

“The only difference in the changes that are made today is to give an assurance and not leave things to vagaries of market forces. The structure of UPS has the best elements of both [OPS and NPS],” Somanathan said.

Key Takeaways

Lump-Sum payment at superannuation in addition to gratuity1/10th of monthly emolument (pay + DA) as on the date of superannuation for every completed six months of service. This payment will not reduce the quantum of assured pension.

Provisions of UPS will apply to past retirees of NPS ( who have already superannuated).

Arrears for past period will be paid with interest @PPF ratesUPS will be available as an option to the employees.

Existing as well as future employees will have an option of joining NPS or UPS. Choice, once exercised, will be final.

Employee contribution will not increase. Government will provide additional contribution for implementing UPS.

The Government contribution increased from 14 to 18.5%

The BuckStopper, run by a group of seasoned journalists, holds the powerful accountable. The buck stops with them, as they cannot shrug off their official responsibilities.